How one healthcare organization is boosting clinical asset performance with big results

By John Beaman, Chief Business Officer and Chief People Officer, Adventist Health and Eric Kammer, Managing Principal, GE Healthcare Partners Consulting

Hospitals and health systems invest millions in capital assets each year, including on clinical and IT equipment. The average U.S. hospital carries more than 19,300 connected medical devices and clinical assets. Unfortunately, this asset portfolio is often fraught with challenges, from capital needs that are greater than funding capacity to assets that consistently (and even unknowingly) underperform. It’s no surprise then that hospitals and health systems have an overall poor return on invested capital (ROIC) compared to other healthcare sectors and industries. Hospitals and health systems see average returns of 6.1%.

A key problem is a lack of accountability for the performance of invested capital, especially in clinical assets. The struggle isn’t new, but incentives to improve capital allocation processes and clinical asset performance are growing. Hospitals and health systems that tapped into emergency capital during the pandemic are now having to defer capital projects due to funding constraints. By improving capital allocation strategies and clinical asset performance, these organizations have an opportunity to increase ROIC, creating greater resiliency, systemwide value, and a new foundation for future success.

Adventist Health’s Journey

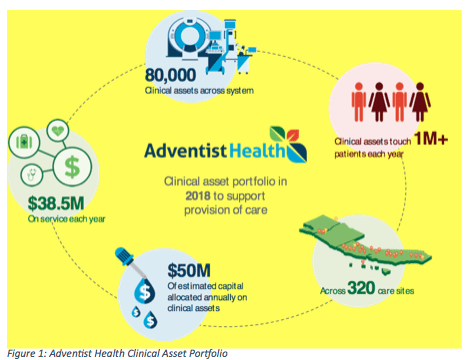

Adventist Health, a faith-based, nonprofit integrated health system with 22 acute care facilities on the West Coast and Hawaii, has faced some of these challenges, spending $50 million a year in allocated capital on clinical assets that were discrete in nature and managed geographically rather than from an aggregate point of view. With the system’s 80,000 clinical assets dispersed across 320 sites, touching 1 million patients a year, Adventist Health and GE Healthcare recognized a tremendous opportunity to reimagine the systemwide planning and utilization of these assets to better position the organization for growth, reduce costs, and improve patient care and experience in alignment with Adventist Health’s mission of living God’s love by inspiring health, wholeness and hope. As a nonprofit, the organization continually looks for ways to reduce costs so that more funds can be invested in services for its communities.

The vision. In 2018,Adventist Health rolled out a clinical technology asset performance improvement plan to aggregate clinical asset spend and services, leverage scale more effectively, and increase ROIC. Top outcomes included providing a top-quartile patient and physician experience, maximizing the capacity of clinical assets, and expanding outreach to serve more people. The outcomes were aligned to the following strategy:

- Facilitate growth by improving access

- Reduce the lifetime cost of owning and operating clinical assets

- Support Adventist Health’s transformation in patient care

- Realize $100M+ projected financial benefit over five years to invest back into Adventist Health’s communities

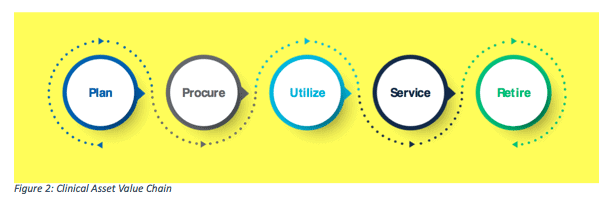

A new path to value. Adventist Health partnered with GE Healthcare to introduce the Clinical Asset Value Chain, a new model that takes what was typically a set of discrete activities around key lifecycle phases and optimizes and integrates them to create long-term organizational value. The model encompasses clinical asset planning, procurement, utilization, servicing, and retirement across four high applications areas: procedural, imaging, lab, and respiratory therapy.

The Clinical Asset Value Chain offered a new lens into clinical asset capital management and performance optimization, providing key insights to both senior and clinical leaders. The asset value chain began to drive aggregate decision-making, ensuring that the right equipment was available to serve patients at the right time. It also supported the organization as it adapted to COVID-19 challenges, including variability in equipment needs.

Long-term success. Over 2+ years, Adventist Health has made significant operational and process changes to dramatically improve clinical asset management and performance. Today, it is on track to reach its five-year $100M+ projected financial impact goal. Together, Adventist Health and GE Healthcare are managing more than 50 initiatives across 17 markets, including:

- In-depth capital planning and allocation: Driving new capital processes by key data points, including utilization, asset age, reliability, and technology level

- Outpatient charge capture: Developing new processes to ensure payment for services rendered across key specialty areas, including emergency, invasive cardiology, interventional radiology, labor and delivery, perioperative services, and oncology

- Increased capacity of imaging assets: Creating a better patient experience by improving access (e.g., streamlined scheduling services, additional appointment slots); and managing costs better through labor productivity standards and market-specific strategies

- Higher surgery capacity: Using real-time data to improve performance and capacity, including redesigning block schedules

4 Key Strategies to Maximize Clinical Asset Performance

Unlocking the long-term value of clinical assets requires a strategic framework along with a consistent and rigorous process that is infused with much different data at every step along the Clinical Asset Value Chain. From the experience over the past two years, leaders identified a handful of strategies to maximize the investment in clinical assets:

Develop a deep understanding of utilization and performance

Hospitals and health systems rarely have an intimate understanding of the full breadth of clinical assets under their control, including how assets perform, their growth potential, and replacement needs. Having baseline information on the following is essential:

- Make and model

- Location

- Technology level

- Age

- Service life

- Portion of the day a clinical asset is used

- Utilization during operating hours

- Reliability

- Annual margin

Most organizations track only a few of the above data points, and therefore lack the complete picture of how the asset is performing. Uncovering the finer data points, such as hours used per day, can reveal critical gaps and areas for improvement. In addition, a world-class and integrated biomedical and imaging service program is required to track, maintain, and calibrate the asset portfolio. For example, at times during the pandemic, demand for ventilators rose to levels not historically seen. As capital requests flooded in, having a deep understanding of the current fleet (including rentals) and details such as make/model, location, and historical utilization provided critical insight into the volume of ventilators needed to ensure Adventist Health had enough equipment to care for patients without overbuying.

Elevate capital planning by integrating utilization and performance data

Information about clinical assets now serves as an essential element in Adventist Health’s capital planning process. The health system leverages standardized tools such as pro formas, business cases, and prioritization matrices. Infusing clinical asset information into capital planning also allows for more objectivity during the challenging process of weighing capital requests. All potential capital needs are considered in a batched review to ensure limited capital dollars are well spent and best align to Adventist Health’s mission, vision, strategic service lines, and financial stewardship.

This meaningful process creates clarity and transparency as to why and how decisions are made across Adventist Health’s 80+ communities. Once decisions are made and capital assets are purchased and installed, it’s essential to create accountability around those initial assumptions, which leaders do through a “look back” to evaluate ROIC. If investments are not performing as expected, they ask “why?”

Focus on the ‘hidden’ factors that can impact outcomes

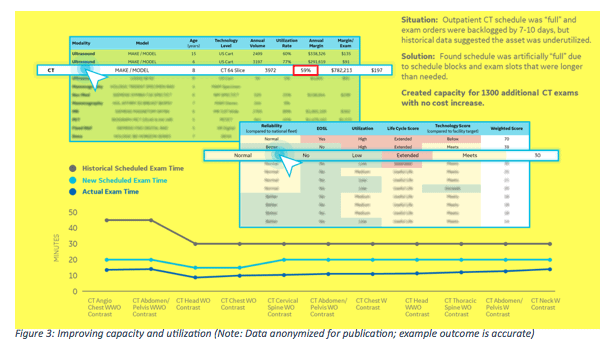

Utilization data is key, but it tells only part of the story about an asset’s performance. Adventist Health and GE Healthcare also want to focus on outcomes since countless clinical services are driven by clinical assets, including OR equipment, imaging systems, and laboratory equipment. It is important to understand how these clinical assets can be leveraged to reduce overall costs and improve care and the patient experience. One way is looking at how the broader clinical environment, including scheduling, staffing, workflows, and hours of operation affect capacity.

As the focus shifted to also include outcomes, leaders are discovering new opportunities to improve scheduling for expensive equipment such as CT scanners. Illustratively, a scanner was fully booked and scheduling 7-10 days out. On closer inspection, right-sizing scheduling slots allowed the team to increase annual exam capacity by over 1,300 exams with no cost increase. Where impactful, the team also extended hours of operation, added technologists, and overlapped slot times judiciously to increase patient access and drive better utilization of imaging assets.

Look for opportunities to improve the operating model and consolidate

As the healthcare industry progresses down the road of integration, service rationalization, and strategic outsourcing, clinical asset footprints will likely shift as well. Having real-time information on the current utilization of clinical assets allows organizations to continually improve and consolidate. Routine questions include:

- Has the organization’s overall need for clinical assets reduced?

- Can assets shift to alternative care sites (e.g., inpatient to outpatient settings) in lieu of purchasing additional ones?

- Can more portable assets move among care locations as patient care needs dictate (e.g., IV pumps, ventilators, monitors)?

Laboratory transformation is a hot topic in healthcare, and a powerful example of how the right strategy can result in significant benefits. Empowered by the Clinical Asset Value Chain, Adventist Health and GE Healthcare were able to improve lab quality, speed, and expenses. Leaders changed their operating model and leveraged larger facilities to integrate lab services at specifically trained and well-staffed hubs that require less equipment, maintenance, and staffing. These centers of excellence drive increased expertise and coverage, which has led to higher quality services, faster turnaround times, and reduced costs.

What’s Next: Innovation, Standardization, and Advanced Analytics

With a solid foundation for managing clinical assets and improving ROIC,Adventist Health and GE Healthcare will focus on securing lasting change by industrializing and scaling the principles and processes of the Clinical Asset Value Chain across the system’s Care Division. Given the size of Adventist Health’s care portfolio, the organizations will continue to scale to unlock long-term value, bolster financial health, and enable ever-increasing care to the communities Adventist Health serves.

Adventist Health will also look to develop next-generation advanced analytics and technology enabled outcomes. Leaders will continually evolve how they leverage clinical assets and push the envelope of innovation, recognizing that the true power lies in having an analytic model that can provide both a real-time and predictive look across the system. Harnessing advanced analytics will drive more precise planning for long-term community needs, allowing the organization to create an exceptional patient and provider experience.

Driving Next-Level Performance in Clinical Asset Management

Hospital and health system clinical assets consistently underperform each year with a poor overall return on invested capital (ROIC). The reasons are numerous, including the fact that the average hospital carries close to 20,000 medical devices and assets, many of which are discrete in nature. Healthcare organizations also struggle with proper oversight for invested capital performance and often lack the right data to drive critical planning.

New incentives to improve

Ongoing financial challenges and continued industry disruption (amplified by the COVID-19 pandemic) are incentivizing health systems to improve capital allocation processes and clinical asset performance. In fact, Adventist Health a faith-based, nonprofit integrated health system, with 23 acute care facilities on the West Coast and Hawaii, has been on a 2+ year journey to optimize performance of its 80,000 clinical assets dispersed across 320 sites. Key targeted outcomes include:

- Performance & growth: Maximize capacity of clinical assets to fuel growth and serve more patients, and improve physician and patient experience

- Financial target: $100M+ projected financial benefit over five years

Accelerating performance

Adventist Health partnered with GE Healthcare to introduce the Clinical Asset Value Chain, a new model that optimizes and integrates the key lifecycle phases of clinical assets to create long-term value. The Clinical Asset Value Chain offers a new lens into clinical asset capital management and performance, providing key insights to leaders, driving aggregate decision-making, and ensuring that the right equipment is available to serve patients at the right time. The collaboration has uncovered four key strategies:

- Developing a deep understanding of utilization and performance by routinely examining new data concerning asset performance, growth potential, and replacement needs

- Elevating capital planning by integrating utilization and performance data of clinical assets in the capital planning process, including standardized tools such as pro formas, business cases, and prioritization matrices

- Focusing on ‘hidden’ factors that impact clinical asset outcomes, including scheduling, staffing, workflows, hours of operation, etc.

- Constantly improving and consolidating the clinical asset footprint, such as transforming the laboratory operating model to integrate lab services at specifically trained and well-staffed hubs

Strong results

Adventist Health has improved clinical asset management and performance across the health system and is on track to reach its financial goal for this journey. Together, Adventist Health and GE Healthcare facilitate more than 50 improvement initiatives, including the following:

- In-depth capital planning and allocation

- Improving outpatient charge capture

- Increasing imaging asset capacity

- Boosting surgery capacity

With a strategic platform for managing clinical asset performance, along with a strong ROIC, the Adventist Health-GE Healthcare strategic relationship is well positioned to pursue new goals, including securing lasting change by industrializing and scaling clinical asset performance principles across the organization. The two organizations will also continue to innovate by developing next-generation advanced analytics and technology enabled outcomes.

The Editorial Team at Healthcare Business Today is made up of skilled healthcare writers and experts, led by our managing editor, Daniel Casciato, who has over 25 years of experience in healthcare writing. Since 1998, we have produced compelling and informative content for numerous publications, establishing ourselves as a trusted resource for health and wellness information. We offer readers access to fresh health, medicine, science, and technology developments and the latest in patient news, emphasizing how these developments affect our lives.