Let’s start with why there is a need to revolutionize the healthcare delivery system and what an ideal healthcare ecosystem could be. If I had written this article just a couple of years ago, the ideal healthcare ecosystem would have been defined very differently than today because the recent COVID-19 pandemic changed the dynamics of the healthcare industry significantly, including the forced accommodation of telehealth services by many providers. As a result, we are experiencing an increase in provider burnouts, clinicians leaving practices and joining other industries, and staff shortages everywhere in the US. This calls for a healthcare ecosystem that can revolutionize how care is delivered.

An ideal healthcare ecosystem

An ideal healthcare ecosystem would be an artificial intelligence (AI)-integrated healthcare system that aligns all healthcare stakeholders productively and efficiently and develops partnerships with traditional healthcare players like hospitals/tertiary care services. This system does not differentiate between patients when it comes to affordability, and it is also transparent. So basically, an ideal healthcare ecosystem would provide lower cost of care and access to quality care for all without compromising the wellbeing of providers, while simultaneously achieving stakeholders’ goals. In this system, everyone gets a piece of the pie. However, one wonders if this is even possible.

Big tech giants and big players in the market famous for making the impossible possible

While big tech giants such as Apple, Google, Microsoft, Amazon, Meta, CVS, Walmart, and Walgreens are famous for making the impossible possible in a variety of industries, for example, retail services, cloud services, supply chain disruption, virtual reality etc., healthcare is a whole new ball game, and it comes with many challenges. Over the past few decades, the big tech giants have been in an ongoing race to see who will capture the healthcare consumer market and disrupt the healthcare delivery system. Since the healthcare business is complicated, it’s almost impossible to bring about revolutionary change. Nevertheless, I believe every big player in the market has the potential and the resources to revolutionize the healthcare delivery system. However, the winner in this race will be the entity that can analyze and strategize intelligently, including playing it safe with the existing highly complex healthcare system. As the saying goes, “If you can’t beat them, join them,” or in this case, join them/acquire them/partner with them and then slowly win them over—in other words, disrupt the healthcare system while making the existing players part of this disruption.

The acquisitions made by the big players in the market must be acknowledged. For example, CVS (along with more than a thousand in-store clinics) recently acquired Signify Health, Walmart acquired MeMD and recently partnered with UnitedHealth Group, Walgreens acquired VillageMD, and Teladoc acquired Livongo. Additionally, other big and small players are also partnering and establishing relationships with healthcare stakeholders. I will focus on Amazon to showcase this big tech giant’s potential to establish an ideal healthcare ecosystem.

Amazon’s potential to establish the healthcare ecosystem

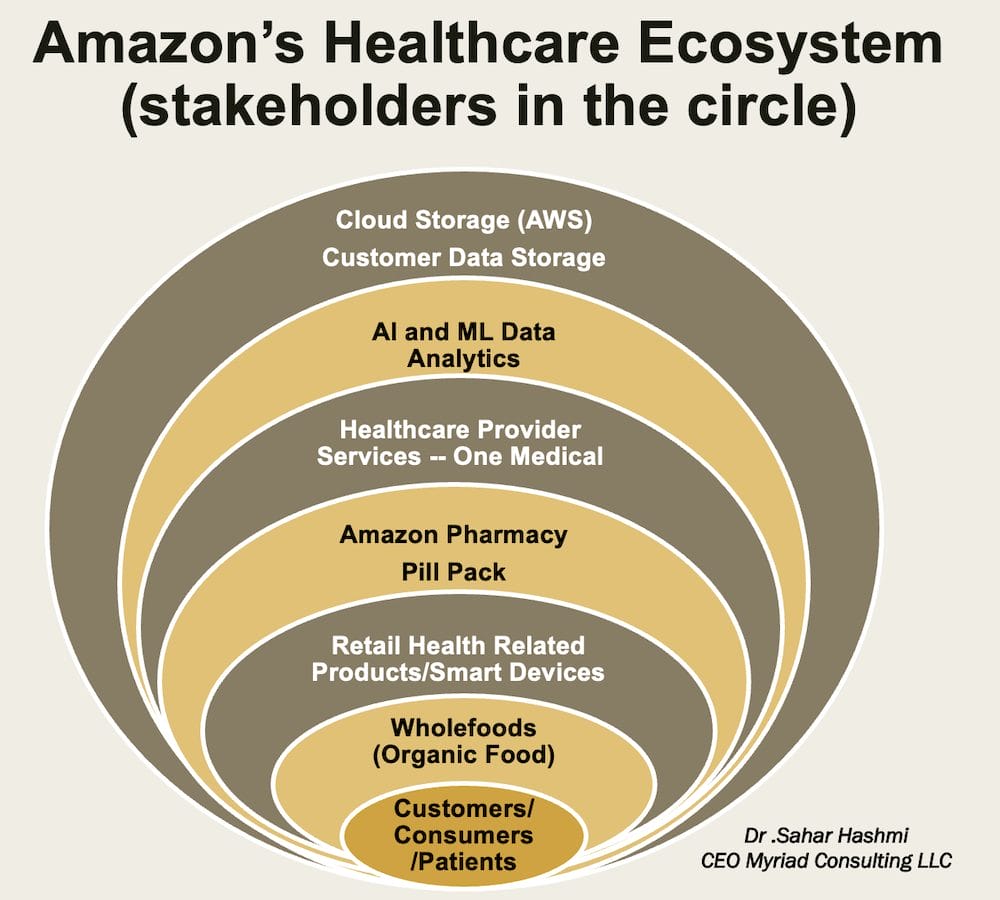

Amazon started by selling books and slowly became one of the largest retailers in the world. It has disrupted the retail market very efficiently. In the potential healthcare space, Amazon acquired Whole Foods in 2017 (healthy and nutritious eating), then PillPack pharmacy in 2018 (easier access to medications), and then One Medical in 2022 (easier access to providers). If this deal with One Medical goes through and proves successful, then Amazon might lead the race, but only time will tell who will eventually win. Here are three main reasons that Amazon has the potential to lead this race. (Figure 1)

1) Stakeholder involvement in Amazon’s existing circle of care

Amazon successfully acquired Whole Foods and created Amazon Fresh, and it also acquired PillPack and started Amazon Pharmacy. Now, with One Medical, it has numerous healthcare stakeholders under its belt. One Medical provides a hybrid model of care for primary care services. It started with one clinic in 2007 and now has 188 clinics, 700,000 patients, and many physicians and staff members to provide care. On the one hand, One Medical was struggling to scale its services before it was acquired by Amazon, but on the other hand, Amazon struggled to enroll patients and providers to Amazon Care. So, if successful, this acquisition could prove to be a smart move by Amazon. Amazon is capable of helping scale services and improve processes’ efficiency, as it did for Whole Foods. With up to $60 billion reportedly allocated to scale One Medical’s services, there is huge potential to capture a big chunk of the healthcare consumer market.

2) Rich customer/consumer data for the AI and machine learning platforms and cloud storage by Amazon Web Services (AWS)

Amazon is growing fast, as is its AWS cloud storage space. As a result, Amazon has a big data analytics platform and rich consumer data at its disposal. Retail shoppers, Whole Foods shoppers, pharmacy users, smart devices’ users and now One Medical service users all contribute to this consumer data. Using this rich customer data could go two ways. It could help revolutionize healthcare in terms of creating new methods for conducting clinical trials, introducing new behavior-change techniques through the use of pattern recognition or customized protocols for care delivery processes, or discovering/inventing new care management pathways. However, on the flip side, customers could be harmed if healthcare regulators do not monitor the security and safety of this data usage. With Apple products like Apple Watch, the consumer data is in a closed IOS system but with consumer data at Amazon, it is scattered and could be owned or accessed by third party vendors which makes the consumer data more vulnerable to cyberattacks. Thus, Amazon would need to build a much stronger security and patient safety system in order to satisfy the healthcare regulators.

3) Global presence of Amazon Prime members

Amazon has about 200 million Prime members worldwide, with 146 million in the US. If it successfully enrolls only one-third of its prime members to build its care delivery model, it could lower the cost of care for its customers. Therefore, Amazon has an immense potential to establish an ideal healthcare ecosystem if it manages to reduce the cost of care without compromising its quality or access to it.

While Amazon seems to be in a strong position to lead this race, let’s not forget that it has faced big failures in the past with ventures like Haven, the Amazon–Berkshire–JPMorgan venture, which was unsuccessful and collapsed in 2021. Thus, one can assume that Amazon will learn from its past failures and might make the impossible possible by winning this race. However, only time will tell if Amazon wins or another big player strikes a better deal with stakeholders and revolutionizes healthcare.

Dr. Sahar Hashmi

About the Author:

Dr. Sahar Hashmi is the CEO of Myriad Consulting LLC - MA, USA. Hashmi is an MD with a PhD from MIT's Business School & IDSS with master in Systems Design and Management. She is a faculty instructor at Harvard and the Titan Business Award winner of 2022 for her creative consulting business.

Expertise: AI in healthcare, modern care delivery, digital health & business transformation and automation, data analytics, metaverse and smart homes/clinics/labs design.