The healthcare sector is changing – not only in the methods used to treat patients – but in the methods used to structure the healthcare sector as a whole. In the past, aside from a few small family practices, almost all medical treatment necessitated going to a large regional hospital and navigating through endless floors of medical offices and treatment rooms.

The medical real estate sector is changing.

The focus of the healthcare industry is no longer on providing one large medical campus. It has turned creating smaller, patient-focused, medical office buildings or MOBs. Creating a mix of outpatient facilities and multi-specialty centers is improving the patient experience. Patients are flocking to these off-campus outpatient facilities. Rather than having to deal with a large and often confusing hospital campus, patients can come to a smaller medical center that groups similar services together in one easy-to-find package. Not only is this retail shift saving patient wait time, but it is reducing medical costs and streamlining treatment.

Medical professionals are also jumping on the medical retailization bandwagon. Doctors, surgeons, and other medical professionals are stepping away from independently-owned practices and are seeking partnerships with hospitals while maintaining an off-campus presence. Hospitals are encouraging this partnership by sponsoring the purchase or construction of off-campus medical office buildings. Current federal requirements are making it difficult to transfer medical practices to independent service providers. Thus a strong partnership with medical specialists benefits both doctors and hospitals. This has motivated hospitals to offer their partnered doctors and surgeons satellite diagnostic and treatment facilities.

The “Retailization” of the medical field is catching the attention of real estate investors.

Multi-specialty centers, freestanding emergency rooms, dialysis facilities, and other healthcare specialty services are popping up in nearly every neighborhood nationwide. According to the 2018 Healthcare Real Estate Outlook report compiled by JLL, the demand for off-campus medical facilities is growing. “By year-end 2018, a full 73 percent of MOB construction projects underway will be in off-campus locations.”

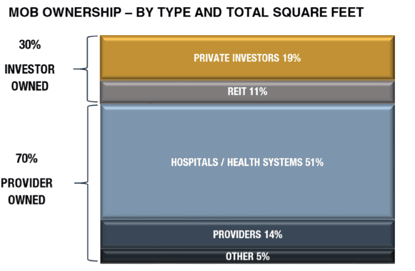

In the past, the healthcare real estate sector was dominated by REITs. They possessed the significant amounts of capital to invest in large hospital construction projects. As MOBs become smaller and more focused, private investors are giving REITs a run for their investment dollar. Based on research completed by Revista and compiled by JLL, 60 percent of medical real estate transactions in 2014 involved a REIT. In the current real estate market, however, REITs own only 11 percent of the MOB market while private investors own 19 percent. According to the Mid Year Revista transaction report, over the last 12 months, “private investor buyers made up 79% of all healthcare real estate sales.”

Historically, most of the MOB market was owned directly by hospitals and health systems. Needing to free up capital to reinvest into patient quality of care improvements, these properties are being sold to investors and leased-back by hospitals.

Healthcare real estate has become a core investment grade asset.

Private investors who are competing against REITs in the medical real estate market are seeking a long-term passive investment with stable returns – and they are finding it. Each of their MOB investments will carry a long-term net lease that can last decades.

Owning a MOB creates a completely passive investment opportunity. The leases are NNN or absolute net. This means the tenant, not the property owner, is responsible for all management and ownership costs. What is more, these long-term leases are backed by a regional hospital’s financial strength. This goes a long way to dramatically reducing investment risk.

Healthcare real estate investment returns are beating other risk-similar investments.

In the same JLL report it was stated that “medical office has consistently offered a 2 percent spread in cap rates over other risk-similar investments.” Medical office is offering median cap rates of 6.7 percent, whereas the office cap and the S&P 500 Dividend Yield are offering 4.2 and 3.0 percent respectively.

The low investment risk backed by an investment grade tenant and an above standard return is making the medical real estate sector almost irresistible to investors. Hence the reason they have invaded the healthcare real estate sector.

I help investors find, fund, acquire and exchange Investment Grade Income Property. My area of expertise is long-term net leased properties to corporate-grade tenants. Our industry research and expertise allows my clients to learn about and access the best sectors, tenants, and opportunities normally reserved for institutional investors.

The Editorial Team at Healthcare Business Today is made up of skilled healthcare writers and experts, led by our managing editor, Daniel Casciato, who has over 25 years of experience in healthcare writing. Since 1998, we have produced compelling and informative content for numerous publications, establishing ourselves as a trusted resource for health and wellness information. We offer readers access to fresh health, medicine, science, and technology developments and the latest in patient news, emphasizing how these developments affect our lives.