By Patrick Vega, Vice President, Corazon, Inc.

Healthcare, specifically the Orthopedics, Spine, and Neurosciences specialties, are in a period of extended and dramatic change driven largely by new models of reimbursement, novel technology, increased hospital-physician alignment, and a heightened focus on demonstrable clinical quality. Because of an aging population and the prevalence of musculoskeletal and neurological conditions, these specialties are among the most attractive to develop in both medical centers and community-based settings.

One of the most important (and ultimately beneficial) by-products of this change is the emergence of deliberate efforts by hospitals to collaborate with their medical staff. What this means in practice is that the management and delivery of the core elements of care (financial performance, clinical outcomes, and operational efficiency) are migrating away from hospitals and physicians working independently (and sometimes at cross purposes to one another) toward increased collaboration.

While fee-for-service reimbursement is currently the dominant model, payment is inexorably moving to models such as bundling, total episode-of-care payment, capitation, and other fixed-fee arrangements. Under such models, the hospital may be the recipient of a single payment, which is then shared with physicians.

Considerations: General and Specific

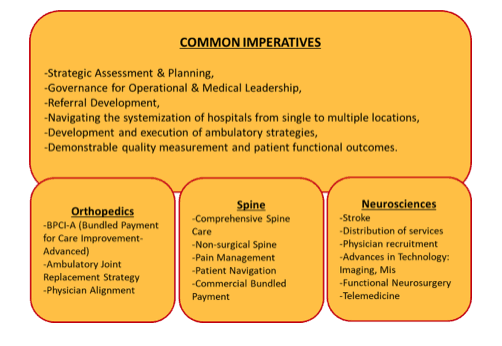

The business of orthopedics, neurosciences, and spine care will continue to rapidly evolve. Common focuses across all specialties will include the following:

Comprehensive Spine

There has been a renewed interest in the spine service line, including the development of comprehensive spine (surgical and nonsurgical spine) as a strategy to integrate ancillary services such as rehabilitation and imaging into a broader system of back and neck care. Historically, many hospitals have been surgically focused because of attractive margins; but, considering that 90% of patients with back and neck pain will not be surgical candidates, health systems and providers are recognizing that they must build a large “front door” of non-surgical services to complement surgical spine. Rapid access, expedited triage to the most appropriate clinical provider, and navigation of the patient through both the clinical and administrative elements of care should all be considered. For many systems, this represents a substantial reset of thinking and therefore requires a reorganization and reallocation of resources.

Ambulatory Joints and Spine

Meanwhile, joint replacement is being driven by reimbursement changes, patient preference, improved pain management, and redesigned rehabilitation.

Today it is estimated that approximately 15% of hospital-based joint replacements could migrate to the ambulatory surgery center providing that the following criteria is met:

- Careful patient selection

- Proper patient preparation and optimization

- Outpatient-specific care pathways

- Fine-tuned surgical technique

- Updated post-operative pain protocols

The certain movement of some joint replacement cases to outpatient status may substantially impact inpatient orthopedic volumes and revenue, thus hospitals and joint care providers must intentionally prepare for and devote resources to this shift to strategically ensure that cases are kept within their system of care, whether inpatient or outpatient.

In the historically outpatient-based orthopedic specialties such as hand and upper extremity, foot and ankle, and sports medicine, opportunities also exist. Corazon recommends that practices and ambulatory providers strategize how to improve access, offer more cost-efficient delivery, and appeal to consumer desire for non-hospital services, all while building an ambulatory brand in the community, spurring referrals and patient loyalty.

Relative to ambulatory spine, historically some spine care has been conducted on an outpatient basis, including pain management, rehabilitation, imaging, cervical discectomy, kyphoplasty, laminectomy, and sometimes fusion. And while it is realistic to anticipate that increasingly complex surgeries will continue to migrate toward the ambulatory setting, that transition will not happen nearly as rapidly as joint replacement.

Rather, the most pressing opportunity for spine is to develop, build, and accommodate more initial non-surgical interventions that include rehabilitation, pain management, and imaging, along with other related wellness services such as behavioral health, nutrition, smoking cessation, chiropractic, and other nonsurgical modalities. This paradigm shift will no doubt require a high level of collaboration among both private and employed spine specialists and hospitals across multiple service locations.

Services – Programs – Centers — Institutes

While many hospitals and medical staff offer spine, neuroscience, and orthopedic “services”, the development of clinical centers of excellence and clinical institutes (the most mature of the models) will present hospitals and health systems the opportunity to concentrate their resources and focus.

These models can drive patient preference and incremental volume in highly-competitive markets. Such centers and institutes with a focus on high-volume and high-quality, supported by patient functional outcomes, can result in substantial differentiation. The most effective programs will educate and market to their current and prospective referral bases with messages of specialization, rapid access, and demonstrable patient outcomes.

Governance

The prevailing model for the organization and delivery of orthopedic, neuroscience, and spine services is often archaic- a vestigial model with discreet and siloed services lacking sophisticated integration, rapid access, and a focus on an exceptional patient experience.

The most successful programs will have:

- FIRST, conducted detailed strategic assessment of their current assets and market opportunities;

- SECOND, have deeply engaged their medical specialists; and

- THIRD, committed to strategic planning as driven by market opportunity, data analytics for cost and utilization, operational metrics, and intelligent distribution of services.

The best strategic planning is crafted with timely data analytics, a sound understanding of costs, and consideration of the vision and aspirations of each stakeholder. The final strategic plan will therefore be viable and endorsed by all constituents throughout the course of development, setting the stage for effective execution.

Corazon believes hospitals and health systems also need to align with their medical staff, whether employed or in private practice. This may include prominent leadership for physicians in operations, finance, and marketing. Financial partnering in such strategies as co-management, gainsharing, and collaborative investment in real estate and clinical services can be viable options. Many physicians, however, remain skeptical and reticent to collaborate closely with hospital administration, yet the emerging market dynamics require a level of collaboration that has been largely unprecedented before now.

Conclusion

The pace of change is accelerating and organizations need to grasp the essential elements, rapidly develop and deploy a strategic plan, all while understanding that course correction will be required as circumstances change. Additionally, these industry changes are creating new opportunities for physician/hospital collaboration with hospitals and health systems actively seeking orthopedic, spine, and neuroscience specialists who are eager to partner in the planning, development, and delivery of care. Both employed and private practice physicians are increasingly pursuing hospital partners who provide medical leadership opportunities that cross all aspects of care: clinical, operational, financial, and quality.

By teaming in meaningful collaborations, hospitals and physician specialists can create and sustain services and quality within specialty programs that neither could achieve alone.

Innovation is Not Enough

With so much dynamism and numerous challenges, healthcare organizations need to intentionally address each one by initiating and adhering to time-tested strategic planning and executions as a foundational first step in achieving substantial and enduring change. While “innovation” is often touted as key to service line vitality, it is simply not enough. In most situations, what is required are very granular processes: assessment, strategy, development, implementation, course correction, and continuous improvement in performance.

Corazon believes that following these key steps can be the difference between success and failure in these critical service lines – amid the intense competition and increasing scrutiny from consumers and the government alike, finding a niche in a regional market can indeed surpass innovation as a sustaining force for a program.

Corazon offers consulting, recruitment, interim management, and information technology services to hospitals and practices in the heart, vascular, neuro, and orthopedics specialties. Find Corazon on facebook at www.facebook.com/corazoninc or on LinkedIn at www.linkedin.com/company/corazon-inc. To learn more, call 412-364-8200 or visit www.corazoninc.com. To reach the author, email [email protected].

The Editorial Team at Healthcare Business Today is made up of skilled healthcare writers and experts, led by our managing editor, Daniel Casciato, who has over 25 years of experience in healthcare writing. Since 1998, we have produced compelling and informative content for numerous publications, establishing ourselves as a trusted resource for health and wellness information. We offer readers access to fresh health, medicine, science, and technology developments and the latest in patient news, emphasizing how these developments affect our lives.

1 thought on “The Near-Term in Orthopedics, Neurosciences, & Spine: Innovation is Not Enough”

Comments are closed.