The way we access and experience healthcare has changed significantly in recent years, with many pointing to the pandemic as a main catalyst. In particular, we’ve seen new trends emerge in how people think about their health and wellness, and in how they select, access and purchase healthcare services.

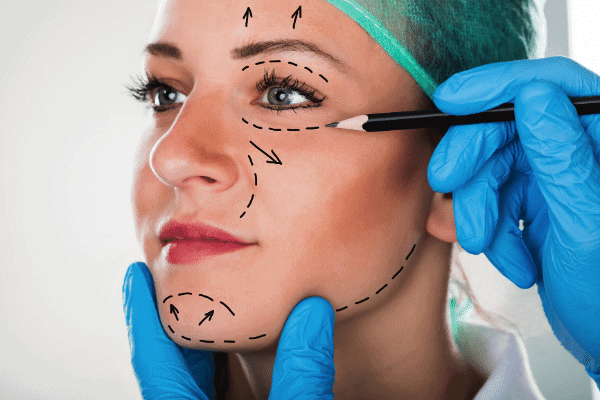

Within cosmetic care, according to data released in 2022 from the American Academy of Facial Plastic and Reconstructive Surgery (AAFPRS), multiple pandemic-related factors have contributed to an increase in cosmetic surgery treatments. Plastic surgeons, in particular, saw “catapulting demand” in 2021 for facial plastic surgery and aesthetic procedures.

As patients’ lifestyles change and the financial landscape shifts, providers are racing to keep pace with evolving treatment requests, expanding their offerings, incorporating more digital solutions, and implementing payment systems that meet the demands of the modern consumer.

Changing Patient Priorities and Payment Needs

Anyone who has worked from home – whether during the pandemic or not – can tell you it results in a massive lifestyle change. Increased time away from the office can allow for more schedule flexibility, and perhaps less time spent getting ready for work appearance-wise. When companies began asking employees to return to the office and society collectively shifted back to more in-person activities, the inevitable happened: People had a desire to look their best and began reevaluating their appearances.

According to additional data from The Aesthetic Society, facial procedures increased 55% in 2021 due to an increased focus on one’s own face as seen on video – “The Zoom Effect.” Remote work goes hand-in-hand with the use of convenient video conferencing tools. With companies ushering in a new trend of workplace flexibility, the use of those tools isn’t likely to go away anytime soon.

In addition to increased interest in cosmetic surgery, we’re seeing the financial needs of healthcare consumers shift. In general, patients are experiencing an increased cost burden across the healthcare landscape. Insurance cost-shifting over the past five to seven years and a complex payment space has required patients to research every step of their health and wellness journey — from making an appointment all the way through paying for the care they received. This has compounded the situation for aesthetics procedures, which are predominantly elective and therefore covered almost entirely by the individual. Being able to pay for not only the healthcare a person needs, but also the elective treatments they want, is just as important to patients as it is for providers.

It’s no surprise, then, that an estimated 41% of adults surveyed currently face healthcare-related debt, ranging from under $500 (16%) to $10,000 or more (12%), according to a report from the Kaiser Family Foundation. According to CareCredit’s 2021 Path to Care Report, one in five consumers without the CareCredit credit card surveyed (21%) state lack of awareness as a barrier to using financing, and 73% of non-cardholders would consider financing if it meant they could move forward with care right away.

The need for flexible and transparent payment options is clear. By providing patients with access to flexible financing, organizations offering aesthetics treatments will be able to offer patients another payment option to make out-of-pocket expenses more manageable.

The Impact on Providers

In addition to experiencing somewhat unpredictable influxes in demand for procedures, providers have also had a variety of factors to juggle – changes in their workforce and the burdens of the pandemic have resulted in their own myriad of challenges. The government has stepped in to provide funding so hospitals can avoid bankruptcy, but many still report not having adequate cash liquidity and the American Hospital Association has continued to request additional funds.

While this issue can’t be solved overnight, one area that can provide relief for organizations is at the point of payment. Offering a multitude of ways to help patients pay for their care after a procedure, combined with clear communication around payment offerings and flexible third-party financing options, help ensure that patients feel confident about the billing process and know which options work best for them. Clear, consistent, and flexible payment processes and options help build patient trust and satisfaction.

While cosmetic procedures are only part of the big picture for providers, it’s a burgeoning area that’s seeing increased demand among patients. As the financial landscape continues to evolve for both patients and providers, financial flexibility on both sides of the equation will be paramount.