By Tom Torre

More than half of Americans—including many employees in the healthcare space—are hopelessly confused by health insurance. And when drilled down to high-deductible health plans (HDHPs) and health savings accounts (HSAs), the confusion only worsens.

In a recent survey conducted by OnePoll on behalf of Bend Financial (Bend), 2,000 respondents, including healthcare workers, were asked to describe their understanding of the U.S. healthcare and health insurance system, using questions about their experiences and current base of knowledge.

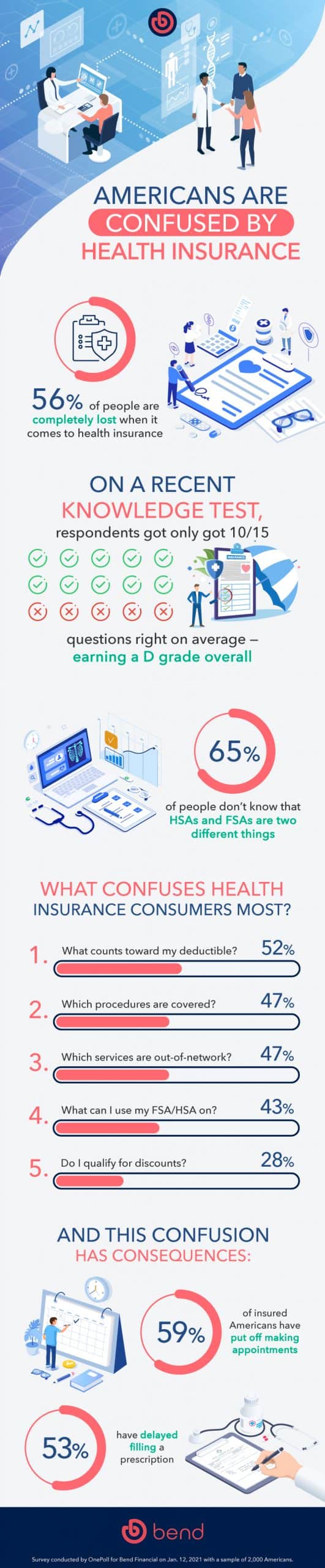

Despite an overwhelming 90% who felt “somewhat” to “completely” confident in their own ability to navigate the current healthcare system, the majority of respondents—56% to be exact—admitted to feeling “completely lost when it comes to understanding health insurance.”

The Average American has a D-Grade Level of Health Insurance Knowledge

The Bend survey also included a series of true/false and multiple-choice questions to test respondents with health insurance coverage on their actual knowledge of the health insurance they have and the U.S. health insurance system in general.

Collectively, the panel of respondents only answered 10 of the 15 questions correctly—a failing D grade on a standard academic quiz.

Only 20% could identify all the correct qualified life events that allow someone to change or enroll in new health insurance coverage outside of open enrollment from a list of options, and 59% mistakenly believed that it’s not allowed to have more than one health insurance plan.

But, while the scope of general health insurance confusion was broad, the survey also identified that the knowledge gap surrounding HSAs is still a major issue in the U.S.

Misconceptions Still Cloud Health Savings Accounts

Forty-three percent of health insurance consumers don’t even know what they can use their HSA for. Perhaps even more alarming, 65% don’t know that HSAs and flexible spending accounts (FSAs) are two different things.

This latter point is a common misconception among health insurance consumers—even those working in the healthcare space. It can’t be assumed that just because an employee works in healthcare, that they’re proficient in health insurance plan options or HSAs.

A Core Concept for All Employees to Understand: HSAs and FSAs are Not the Same

At first glance, HSAs and FSAs can appear to be very similar, but there are many critical differences that separate the two.

Most notably, an HSA is a savings account, while an FSA is a spending account. When compared side by side, HSAs offer many advantages FSAs lack, both for employers and employees, in terms of flexibility, portability and tax savings potential.

With an HSA, the accountholder owns their account and keeps their funds even if they leave their job, switch insurance plans or retire. They can choose their HSA provider, change their contributions at any time and roll over HSA funds year to year without penalty. With an HSA, accountholders can even invest their funds as a long-term retirement-planning vehicle. All these advantages are absent from an FSA.

And, when it comes to tax savings potential, an element that makes HSAs so unique and tax-advantaged for both employees and employers is that on top of lowering an employee’s overall taxable income, employee pretax HSA contributions through an employer-sponsored HSA program are also not subject to FICA taxes for the employee or their employer.

HSAs are one of the only tax-advantaged accounts that offer this added financial benefit to employees as well as employers. Even pretax 401(k) contributions are still subject to FICA taxes. And though IRA contributions can be described as “before-tax,” employees have already paid FICA taxes on those contributions.

Health Insurance Confusion Has Real Consequences

All this confusion has real-world consequences for health insurance consumers.

On average, respondents with current health insurance coverage estimated that they waste $111 per month simply on confusion over their health insurance plan.

Even with health insurance coverage, 59% have put off making medical appointments and 53% have put off having a prescription filled out of uncertainty. And, out of all respondents regardless of health insurance coverage, more than 35% have delayed getting a necessary checkup out of concern for how much it would cost.

A Call-to-Action: Educate Employees Early and Often

Health insurance confusion leads many employees to simply stick with the status quo or end up choosing the “wrong” health insurance coverage for their needs. This ends up costing the employee and the employer money and headaches.

That’s why it’s critical for employers to educate employees early and often on all things employee benefits—especially the advantages of an HDHP paired with an HSA.

Unfortunately, many employees, even those working in healthcare, don’t understand that pairing an HDHP with an HSA can be their key to unlocking the health insurance puzzle. The HDHP/HSA combination can provide affordable premiums and multiple tax savings opportunities while helping chart a path toward better overall financial health.

Ultimately, it’s up to employers to help bridge the knowledge gap and encourage employee adoption and engagement in optimal benefit choices—something that needs to be addressed more than just during open enrollment season.

With year-round, proactive education, employers can create a healthier workplace with more motivated, less financially stressed employees and an overall more productive, happier workforce. All while achieving cost savings from an employer standpoint.

Choose an HSA Partner that Makes HSA Education Easy

Benefits education is key for all employees. And, targeted education surrounding HSAs is a critical component.

For employers already offering an employer-sponsored HSA program paired with an HDHP option, it pays to evaluate the employee education tools and support they have access to through their HSA provider. If an employer is left to their own devices to educate their workforce, it may be time to consider choosing an HSA partner that provides the employee education and resources to make HSAs easy for everyone, regardless of their level of HSA knowledge.

For employers that offer an HSA-eligible HDHP but don’t offer an employer-sponsored HSA program, as well as those that don’t even yet offer an HSA-eligible HDHP option, understand that consumer demand for HDHP/HSA coverage continues to grow rapidly as employees become more educated and understand all the benefits an HDHP/HSA combination offers. Not completing the HDHP/HSA puzzle can negatively impact employees, employers and bottom lines.

Consider benefit education a priority at any time of year. Don’t assume employees know everything they need to. Focus on HDHPs, HSAs and other value-added options that benefit both employees and employers. Then, enjoy upticks in optimal benefit engagement come next open enrollment season.

Tom Torre is CEO and co-founder of Bend Financial. For nearly 20 years, Tom has led organizations in the consumer-directed healthcare space. With Bend, he leads a dedicated team helping individuals, employers, financial institutions and other partners leverage a next-generation HSA platform that improves financial wellness and simplifies healthcare saving.

The Editorial Team at Healthcare Business Today is made up of skilled healthcare writers and experts, led by our managing editor, Daniel Casciato, who has over 25 years of experience in healthcare writing. Since 1998, we have produced compelling and informative content for numerous publications, establishing ourselves as a trusted resource for health and wellness information. We offer readers access to fresh health, medicine, science, and technology developments and the latest in patient news, emphasizing how these developments affect our lives.