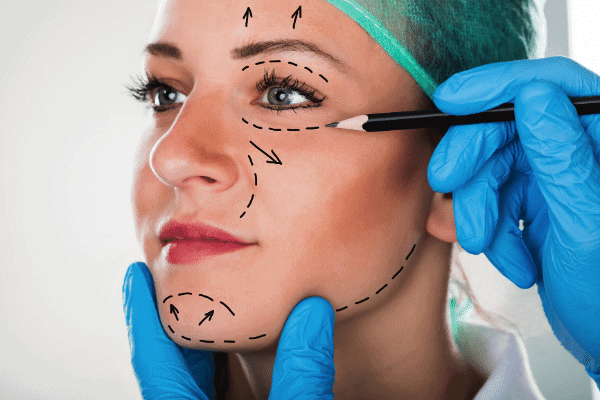

With Americans more interested in looking and feeling their best than ever before, and the advances in methodologies for plastic surgeries advancing every day, it’s no surprise that cosmetic surgery is booming. From breast augmentation, weight loss surgery and tummy tuck to eyelid surgery and hair restoration, there aren’t many areas of the human body which a modern cosmetic procedure can’t nip, tuck, tweak, revise or improve. Unfortunately, a lot of people rush into cosmetic surgery without getting critical information first, which comes back to haunt them later.

Companies in this space work with a broad range of lending partners to help patients manage the high average cost of plastic surgeries and other medical expenses, even when health insurance and crowdfunding sites can’t or won’t help. Before starting on the journey to a new self-image, here are a few questions prospective candidates for plastic surgery procedures should consider.

What is the difference between plastic surgeons and cosmetic surgeons?

A plastic surgeon is specially trained and certified to deal with revision and correction of issues arising from injuries, birth defects or illness, such as addressing a cleft palate or burn scarring which impact the patient’s overall quality of life or ability to function. A plastic surgeon’s services may be covered by health insurance if a medical need can be shown.

Unlike a plastic surgeon, many cosmetic surgeons take on aesthetic surgery as a sideline or additional revenue stream, rather than their primary field of practice or concentration. Cosmetic surgeries are almost always classified as elective procedures by health insurers, meaning patients may have to tap their own checking accounts, bank or credit cards or healthcare savings accounts to access the care they desire—and in the case of the latter, may find their HSA doesn’t allow them to use the funds for elective care. This leads many patients to consider financing plastic surgery through other means. Checking to make sure your cosmetic surgeon is a member in good standing of the American Society for Aesthetic Plastic Surgery can help alleviate worry about the quality of care you can expect from your healthcare provider.

How much does it cost to get plastic surgery?

Depending on the type and scope of procedure you’re interested in, a cosmetic procedure could cost $400-$6,000 and up, factoring in ancillary costs like medications, time off work and pre- and postop visits and checkups. While some plastic surgeons offer payment plans, the quality and fine print of these plans varies widely, with little oversight, meaning even patients with excellent credit could get zapped with high interest rates and monthly payments which could affect your credit rating. Some patients, and not necessarily those with bad credit, manage these costs by considering cosmetic surgery overseas, while others turn to crowdfunding sites or financing plastic surgery by getting loans through their bank or credit union, often at annual percentage rates comparable to a high-interest credit card.

Should you use a personal loan to pay for cosmetic surgery?

Whether a personal or unsecured loan is right for your situation depends on a number of factors. The state of your personal finances, including auto, home and student loans, other collateral-backed or unsecured loans, annual fees and interest rates all play a crucial role in determining whether a cosmetic surgery loan will benefit you. Some of these companies in this space will work with a variety of lenders, giving loan applicants access to the best possible range of options for their financial and credit situation. With loan amounts for medical procedures, supplies, devices and healthcare up to $35,000 available on approved credit with competitive rates, starting a line of credit with providers may be the best way to balance the patient’s aesthetic objectives with their financial goals.

The Editorial Team at Healthcare Business Today is made up of skilled healthcare writers and experts, led by our managing editor, Daniel Casciato, who has over 25 years of experience in healthcare writing. Since 1998, we have produced compelling and informative content for numerous publications, establishing ourselves as a trusted resource for health and wellness information. We offer readers access to fresh health, medicine, science, and technology developments and the latest in patient news, emphasizing how these developments affect our lives.