Key factors to consider

Like so many other sectors, health care is experiencing a technology revolution. From telemedicine to the digitization of services to automation, the market continues to evolve to meet patients’ needs. One might think this increase in technology means virtual environments and the end of the need for in-person, physical medical facilities, but that’s not entirely the case.

Health care leaders and providers continue to remain flexible and adaptive with these new digital environments to meet the sophisticated needs of health care delivery. A key example is the growth of outpatient services in facilities outside a hospital or traditional health care facility. In fact, according to Jones Lang LaSalle Incorporated (JLL), health care transaction volume hit a record-high in 2022 with approximately $26 billion invested into the sector. Investors continued to be drawn to medical office buildings, which comprised the largest portion of investment in 2022 at 58%, and, of the investors surveyed, 66% indicated medical office buildings would remain the biggest investment opportunity in 2023. However, with the shift to more and more outpatient care, ambulatory surgical centers (ACSs) comprised a larger portion of sales, representing 27% in 2022 compared to approximately 20% in 2021Investors continue to be drawn to medical office space as more services become available in an outpatient setting.

Meeting patient needs with technology and facilities

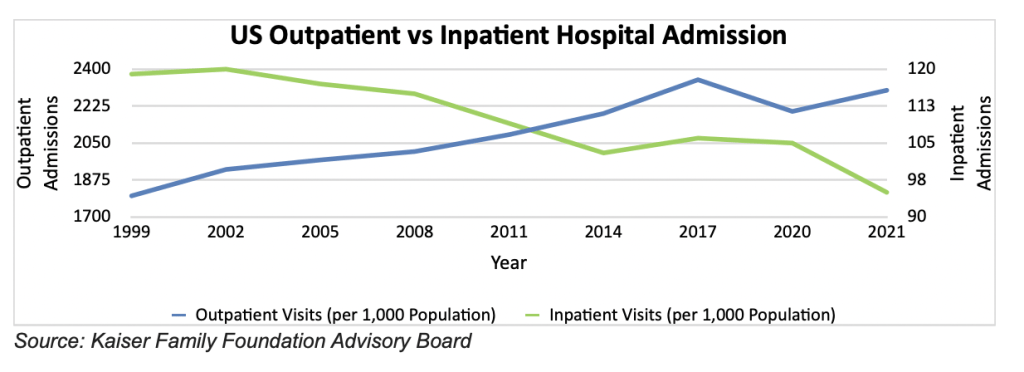

During the pandemic, providers had a difficult time connecting with their patients. As innovative technologies became more available to improve connectivity and convenience, along with changes in reimbursement, the industry shifted more care from inpatient to outpatient. Procedures and surgeries that were once only offered as an inpatient admission are now provided in an outpatient setting. Aside from COVID-19 admissions, surgical-related admissions have been declining over the past five years while outpatient admissions have increased. According to Kaiser Family Foundation (KFF), spending on Part B benefits, including physician services, hospital outpatient services, physician-administered drugs, and other outpatient services, increased from 41% in 2011 to 48% in 2021, and now accounts for the largest share of total spending on Medicare benefits.

Because of this, many hospital systems are shifting their care model by developing or acquiring outpatient sites to meet patient needs while also capturing this strong revenue stream.

It’s clear. Space needs are expanding for new opportunities like outpatient services, but are these new and sometimes adapted facilities ready for state-of-the-art digital demands?

Adapting facilities

Increasingly in this new expanding outpatient market, small, local commercial real estate venues, which traditionally catered to tenants with minimal networking requirements, are finding themselves in the spotlight with the health care sector. However, while the space and location are appealing, in order to deliver the same level of services as that of traditional hospital campuses or industrial and business parks, these venues often must be retrofitted to accommodate an increasingly digitized future. It’s an important consideration and cost for health care businesses and organizations to weigh, or, for landlords to consider as they ready properties for the health care marketplace.

At the same time, it’s noteworthy to mention, medical office tenants tend to remain in locations longer, providing stable occupancy, making it a good reason for facilities investment. According to Colliers, average rents for medical office buildings ticked up to $22.61 per square foot in 2021, a year-over-year increase of 1.7% and a new high for the sector. The national vacancy rate fell by 10 basis points to 8.3%—a metric that’s especially positive when viewed against the broader office vacancy rate of 14.8% in 2021.

The health care sector has proven to provide strong tenants for commercial real estate, and that doesn’t seem to be changing any time soon.

Preparing for expansion

What are some key considerations health care leaders and providers should weigh related to facilities expansion? While the following is not an exhaustive list, addressing some of these areas will determine strategic next steps.

- Understand growing patient needs and population in your marketplace.

- Evaluate how to provide more accessibility for patients and families to receive care.

- Determine key services, new diagnostics and technological needs to provide services.

- Assess current facility space and determine new opportunities for expansion.

- Develop a strategic plan for investors and partnerships, identifying newer revenue opportunities.

- Explore credits and tax incentives to support expansion planning.

The takeaway

The surge in technology in health care does not point to the demise of the medical office. Rather, expansions in technology innovation and the growing medical needs of an aging population require a physical space for services and care. According to JLL, nearly 90% of office visits are still occurring in-person with telehealth declining to 10% of all visits after a high of 54% during the pandemic.

Patients still want to go to the office. Smart health care providers will continue to strategically acquire medical office space to expand accessibility and innovate facilities that meet their growing needs.

Michael Haas

Michael Haas is a technology management consulting manager in RSM US LLP’s health care industry practice. In 2022, he was selected for the firm’s Industry Eminence Program as a senior analyst covering the health care industry, working alongside the firm’s chief economist and other program participants to analyze the trends and themes affecting the nonprofit and education industry and shaping middle market businesses. Michael is based out of RSM’s New York City office.