Despite recent data suggesting an improving supply-demand dynamic, many healthcare providers are still experiencing acute staffing pressures for patient-facing roles.

Healthcare providers finally received some good news on the labor and employment front during 1Q 2023. According to Bloomberg Intelligence, wage growth for staff has slowed considerably across all healthcare segments since the fall of 2022. For a short while, this should restore some operating margin and allow providers time to consider their options for tackling the ongoing shortages of staff and reallocating resources where they are most needed. Many providers are struggling with two seemingly antithetical propositions at the same time; as they work to address patient-facing staff shortages, many providers are implementing workforce reductions in other areas. According to Becker’s, 53 hospitals and health systems have trimmed their workforces over the past nine months with many of the cuts impacting nonclinical and management roles. Together with the slowing pace of wage inflation, these actions should help ease—at least temporarily—the financial and operational pressures healthcare providers have experienced throughout the beginning of 2023.

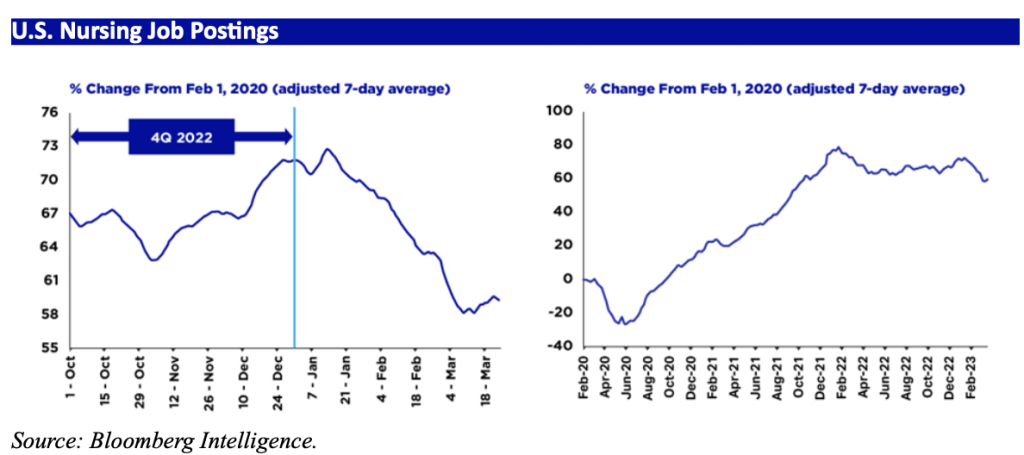

While the improving wage inflation dynamic is helpful in easing the pressure the short run, patient-facing staff shortages are likely to persist well into the future. Providers should continue to consider longer-term strategies for containing the costs associated with these staffing issues. Clearly, the reliance on expensive contract labor has hit budgets hard. At the same time, we have seen a notable rise in demand for staff nurses since February 2023. As Bloomberg captured it, “[p]roviders’ efforts to replace costly contract labor with full-time staff are behind the recent increase in demand for nursing jobs.”

As providers continue to rotate into full-time staff solutions, there are some legal and operational considerations that bear upon the implementation of this approach. The costs associated with contract staff positions is significantly higher than permanent staff positions, especially when viewed in the short run. During the height of the Covid pandemic, it was not uncommon to see weekly travel nurse compensation range as high as $10,000 per nurse, and even as travel nurse compensation has reverted to something closer to the mean, it still outpaces that of permanent staff.

The Nurse Is Out

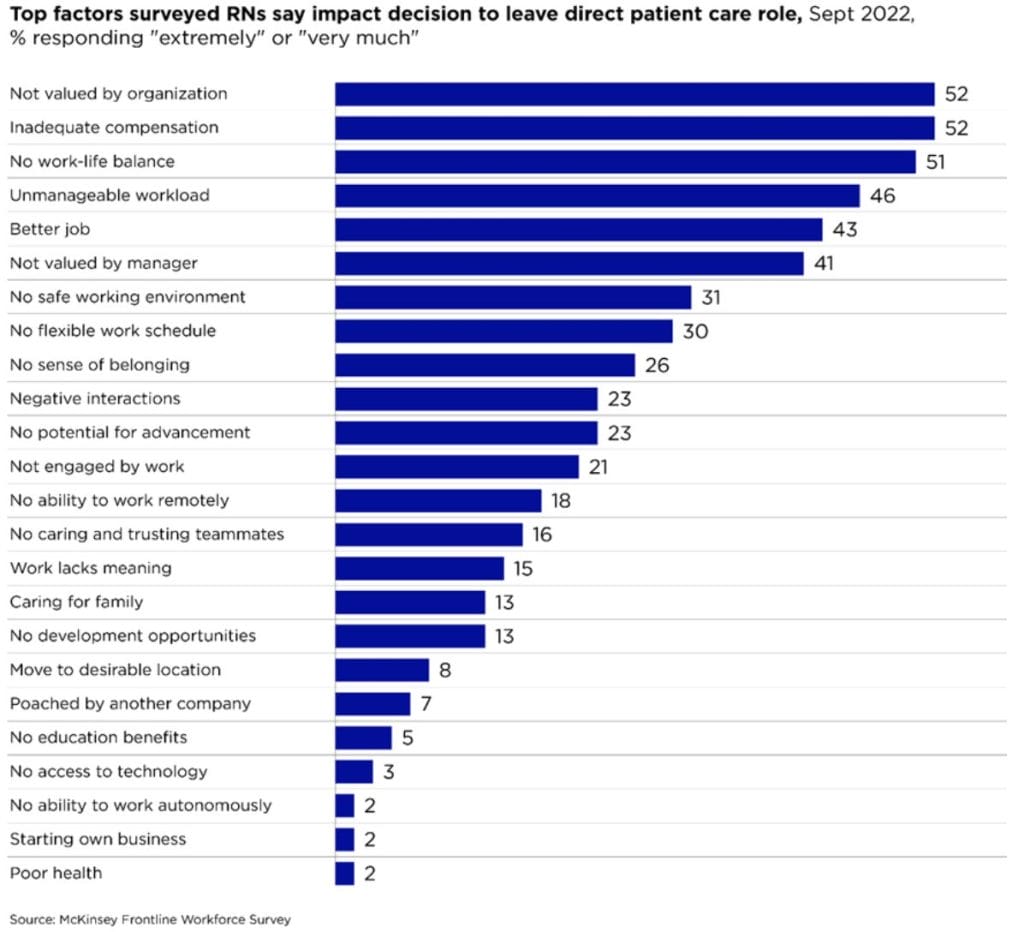

According to a survey by McKinsey & Co. published in May 2023, 31 percent of nurses in direct patient care jobs are contemplating leaving their positions during the next year. The factors responsible for this are many, but most frequently cited were feelings of being undervalued, underpaid, and overworked. A lack of job flexibility and safety concerns also rated prominently among survey responses.

Obviously, a mass departure of frontline nurses would be a devastating blow for the healthcare industry. The existing shortages have been difficult to solve, and this circumstance would be greatly exacerbated by additional nurses exiting the workforce. Even if replacements were readily available—an unlikely short-term scenario—the costs associated with nurse turnover is considerable. According to the 2023 NSI National Health Care Retention & RN Staffing Report, the average cost of turnover for one staff RN increased 13.5 percent from 2021 to 2022, to $52,350.

For providers contemplating an increase in full-time staff, therefore, retaining nurses might be an even greater source of concern than recruiting and hiring. Increased headcount could also result in an increased revolving door of departures, and the hidden costs of such staff turnover should be considered from the start. Slowing down or stopping these departures requires providers to address the major reasons nurses leave their jobs, and those solutions, too, come at a cost. Most obviously, addressing the compensation issue involves money, but solving the cultural challenges of the workplace often involves investing in and enhancing a variety of employee programs and services, from onsite amenities to management training and wellness programs. Again, these costs—as discretionary as they may be—should be accounted for when charting a strategic direction for the future.

The Advent of Minimum Staffing Laws

Even if a healthcare provider is fortunate enough to make progress on the goal of increasing full-time staff headcount, it may not satisfy state and federal lawmakers who are busy moving the regulatory goalposts. As it often is, California was the first state to pass a minimum staffing law—now over twenty years ago—and it is still the only state to legally require a specific nurse-to-patient ratio in every hospital unit, although several states require providers to publicly report ratios. At the beginning of 2023, four states—Washington, Oregon, Massachusetts, and Connecticut—had draft legislation mandating nurse-patient ratios, all with significant support from organized labor (the Washington and Oregon legislation were signed into law in April and August, respectively).

There is movement at the federal level as well. Organized labor has won the support of Senator Sherrod Brown (D-OH) and Congresswoman Jan Schakowsky (D-IL) concerning draft legislation that would establish a minimum staffing level for nurses and also provide for whistleblower protection. Similar legislation was introduced in 2021 but died in committee.

Providers should pay close attention to this iteration of the proposed law. The bill requires hospitals to implement and submit to the Department of Health and Human Services (HHS) a staffing plan that complies with specified minimum nurse-to-patient ratios by unit. Hospitals must post a notice regarding nurse-to-patient ratios in each unit and maintain records of actual ratios for each shift in each unit. The bill also requires hospitals to follow certain procedures regarding how ratios are determined, and other staff are prohibited from performing nurse functions unless specifically authorized within a state’s scope of practice rules, among other requirements. HHS must adjust Medicare payments to hospitals to cover additional costs attributable to compliance with these ratios.

Furthermore, nurses may object to—or refuse to participate in—an assignment if it would violate minimum ratios or if they are not prepared by education or experience to fulfill the assignment without compromising the safety of a patient or jeopardizing their nurse’s license. Hospitals may not (1) take adverse actions against a nurse based on the nurse’s reasonable refusal to accept an assignment; or (2) discriminate against individuals for good faith complaints relating to the care, services, or conditions of the hospital or related facilities. HHS may impose civil monetary penalties on hospitals violating the ratio requirements and must publish the names of such hospitals.

If federal minimum staffing legislation was to be passed—or if a sufficient number of states passed similar legislation—it would turn back the clock on healthcare providers’ efforts to leave the contract staff, or travel nurse, model. The unintended impact of such laws is obvious—when government mandates demand without any real ability to affect supply, then providers are left to square the circle, and in this case, the only practicable option would be to hire on more contract staff to satisfy the mandated nurse-patient ratios (or, perversely, to admit fewer patients).

Looking Overseas for Solutions

Multiple hospitals and health systems have ramped up their international recruitment of nurses to address these shortages. U.S. healthcare providers already have a structural dependence on foreign-born nurses, who comprise 15 percent of the U.S. nursing workforce, according to Bloomberg Law, but limited temporary visa options, the shortage of green cards, and expanded queues and processing times are constraining the ability of providers to tap this resource at higher levels.

Short-term solutions to bring in foreign registered nurses are often limited to those from Mexico and Canada under the TN visa program. The primary employment nonimmigrant visa, the H-1B, is typically only available for advance practice or specialty nurses. Furthermore, except for certain nonprofit and academic medical centers, hospitals must complete for the 85,000 H-1Bs allotted each year in an annual “Lottery”. For the FY2024 Lottery held in March 2023, there more than 700,000 entries for these coveted H-1B slots.

Those hospitals and health systems taking the long-term route also face challenges. Even with a streamlined process for nurses and other shortage occupations called Schedule A, it may take a full year just to get an approval from USCIS for a foreign nurse. The wait for a visa interview at a U.S. Consulate may be just as long. Per the U.S. State Department’s July Visa Bulletin, only those whose employer-sponsored immigrant visa petition was filed in February 2022 would be eligible for visa interview and final immigrant visa (green card) approval. The wait time is even longer for those nurses from China and India. Thanks to these backlogs, the process of sponsoring a green card candidate could take multiple years before yielding results; therefore, newly launched international recruitment efforts are not likely to make an impact on current staffing challenges.

Given that many of the healthcare providers currently interested in international recruitment have very limited experience with immigration law, it is important for providers to consult knowledgeable counsel on the issue to make sure that their tactics and strategies align with the underlying reality. The bottom line is that absent emergency federal legislation, it is difficult to see a material increase in the number of international nurses in 2023 and the foreseeable future.

Conclusion

Staffing costs can consume nearly half of a healthcare provider’s net operating revenue—sometimes more—and continues to be a high-priority issue, both in terms of addressing shortages in critical areas as well as in aligning headcount with prevailing macroeconomic conditions. As administrators seek to implement solutions that control costs and enhance patient outcomes, the way corporate strategy integrates with the legal and regulatory setting can go a long way towards determining success.