As the U.S. population continues to age, the demand for senior living and care options is growing at an unprecedented rate. According to the latest report from Integra Realty Resources’ Healthcare & Senior Housing practice group, the growth of the 75+ demographic is significant and will only continue to increase over the next five years. But what does this mean for the senior housing industry, and how can developers and investors meet the growing demand for these types of properties? In this article, we will examine the key findings from the report and explore the implications for the senior housing industry.

The Rising 75+ Demographic

The number of Americans aged 75 and older is increasing significantly, growing from 18.5 million in 2010 to 24.4 million in 2023, a growth of 31.4%. This growth is expected to continue over the next five years, with a forecasted growth of 9.6% in the 75+ demographic and 7.7% in the 85+ demographic. The higher income demographic is expected to grow even faster, with the $75,000+ demographic forecasted to grow by 27.8%. This is important for the seniors housing industry, as higher income householders are better able to afford these living options.

As the 75+ and 85+ age demographic continues to grow, it will have significant implications for healthcare, housing, and other services that cater to the needs of older adults. Seniors housing offers independent living, assisted living, and memory care options to meet the needs of their residents. Independent living facilities are for seniors who are healthy and able to live independently, but desire social activities and amenities. Assisted living facilities provide help with daily living needs while still allowing residents to maintain independence. Memory care facilities are for seniors living with Alzheimer’s, dementia and other memory related conditions.

Approximately 26% of assisted living residents are in the 75-84 age demographic while 55% are in the 85+ age demographic, according to the National Center of Assisted Living (NCAL). The industry will need to consider the financial resources of seniors, as well as the growth in the senior population when assessing future demand for seniors housing.

Affordability and Income Impact Seniors Housing Demand

Seniors housing can be costly and often unaffordable for many seniors due to lower median incomes for households headed by someone aged 65 and older compared to all households. The National Investment Center for Seniors Housing and Care reports that seniors housing costs an average of $67,000 for assisted living, $45,000 for independent living, and $95,000 for memory care, with variations depending on location and other factors. While some states offer financial assistance programs such as Medicaid, many seniors have to pay out of their own pocket, using their savings and selling assets to fund their stays. As demand for seniors housing options continues to grow, affordability will need to be addressed.

The growth of seniors with higher incomes is a significant factor to consider in seniors housing demand. Currently, there are 6.5 million U.S. householders over the age of 75 with incomes above $50,000, projected to increase to 7.9 million by 2028, an annual growth rate of 3.7% or 20.2% in total. The $75,000+ demographic is expected to grow even faster at 5.0% annually, making it an important factor in determining seniors housing demand for newer facilities that will likely compete towards the higher end of the market. The 75+ age demographic with annual incomes of $50,000 and higher, which we’ll refer to as the Target Market Demographic (TMD), has the highest correlation to seniors housing demand across all levels of care, according to the analysis.

Forecasting Supply Needed to Meet Demand

Supply and demand are not always in perfect balance, and the construction of new facilities can affect this balance. Therefore, estimating the total demand for senior housing is not enough to determine the exact number of units that will be required to meet this demand.

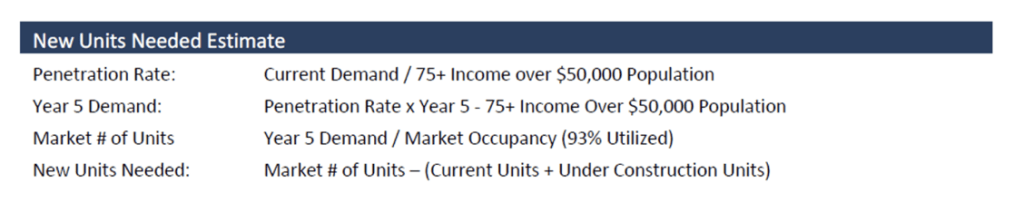

The calculation of the potential supply needed involves determining the penetration rate—which refer to the percentage of a particular population or market that uses a particular product or service—year 5 demand, market occupancy rate, and new units needed, based on the current demand and the population of seniors with an annual income over $50,000.

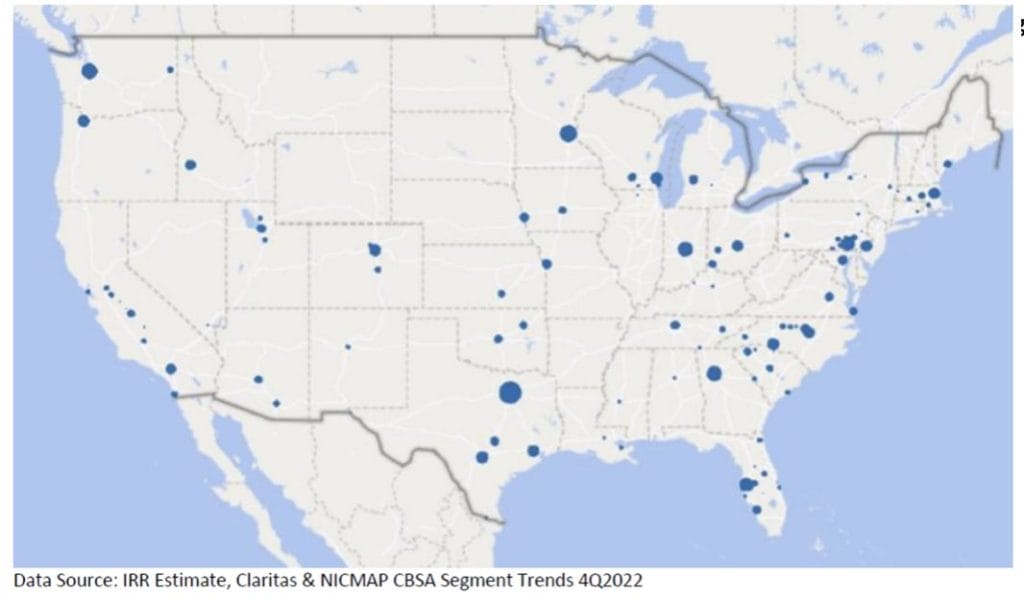

The map below provides a visual representation of the supply needed in each market, with larger circles indicating a higher number of units needed. Note, negative markets are not included.

Looking at the top 25 Core Based Statistical Areas (CBSA) with the highest number of needed senior housing units that are highlighted in the report, Dallas, TX tops the list needing close to 4,900 units. Minneapolis, MN, Seattle, WA, Atlanta, GA and Indianapolis, IN, follow behind needing 2,732, 2,337, 2,298 and 2,140 units respectively. Other markets included on the top 25 list include, Tampa, FL, Lancaster, PA, San Antonio, TX, Houston, TX and Charlotte, NC to name a few.

Capturing the Future Market

As the population of Americans aged 75 and older continues to grow, the demand for healthcare, housing, and other services that cater to the needs of older adults will also increase. Seniors housing, including independent living, assisted living, and memory care, offers a range of services and amenities to meet the needs of these residents. However, the cost of seniors housing can be a barrier for many seniors, and affordability must be addressed. As the industry continues to grow, developers and housing providers who address affordability concerns and cater to the growing market of seniors with higher incomes may be well-positioned to capture demand in the future. It is crucial for the industry to assess the financial resources of seniors and provide suitable housing options to meet their needs. With a forecasted growth of 9.6% in the 75+ demographic and 7.7% in the 85+ demographic over the next five years, the industry must continue to adapt to the changing demands of the aging population.

Bradley Schopp

Bradley Schopp is a highly experienced National Practice Leader with Integra Realty Resources’ National Healthcare & Senior Housing group. With over two decades of experience in the appraisal and consulting of seniors housing and healthcare properties, he has completed assignments across 37 states with asset values exceeding $10 billion. Bradley has served as a valuation expert witness and regularly completes appraisal and market study reports. For more information on healthcare and senior housing market studies and valuation topics, please visit https://www.irr.com/healthcare-and-senior-housing.