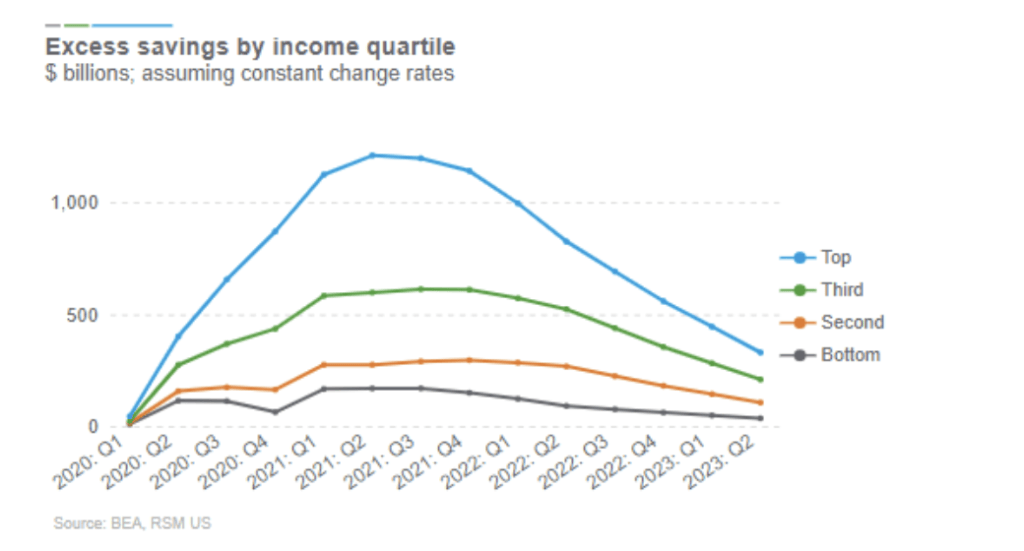

Unpredictable health care bills during an economic cycle where interest rates and inflation remain elevated can disrupt how consumers seek out health care services. As shown in the chart below, excess savings by personal income quartile continues to decrease overall in 2023, which may signal consumers are facing headwinds on how or if they can afford health care services.

This trend may lead to consumers delaying or even foregoing health care services, which may negatively impact consumers’ overall health and add strain to an already beleaguered health care ecosystem.

Could fintech companies provide an alternative way consumers can support the cost of their medical care? The following explores more.

Fintech in health care

Fintech companies deliver financial products to consumers by leading with technology which can often result in increased speed, streamlined operations and an overall better experience for consumers. One of the popular fintech trends that consumers are preferring is the use of buy now pay later (BNPL) payment options. BNPL allows consumers to pay for a purchase in installments with zero interest charged.

According to a KFF report, 41% of adults currently have medical debt which range from under $500 to over $10,000. Further, some families may have to pay multiple bills for multiple individuals at one time. This can be overwhelming and financially stressful. However, breaking up the payments into more manageable amounts over a period of time and utilizing a fintech platform to do that provides the consumer with a sense of financial stability and can help navigate a path forward to seek out future health care services.

In addition to BNPL, a super app, which has become a must-have feature for fintechs, can offer a better customer experience in the health care ecosystem. This solution pulls together many apps with different functionalities into one ecosystem. An example of what this may look like for health care is an app that manages payer resources and supplier networks, can book appointments and allow for services to be paid for digitally. In addition, the app could facilitate telehealth appointments, send prescription reminders, send prompts for upcoming tests and doctor appointments, provide health education via a learning component, or automatically send forms for approval for services, like being referred to a specialist. Essentially, the super app would be a one-stop shop for all health care-related needs.

Managing health care costs through fintech

While hospitals and health systems are required to be transparent with their fees, this doesn’t always translate to what a consumer is obligated to pay. Some consumers have insurance with deductibles that require them to pay out of pocket until the deductible is met or provides partial coverage, while other consumers may not have any insurance and have to pay the full health care service amount. Likewise, some health care services are planned and the consumer is aware of the upcoming cost. However, many times a consumer may need surgery from an accident or a readmission to a hospital from a complication. These expenses cannot be planned or foreseen, and this is where fintech’s BNPL financing option may provide relief.

Health care recently has seen a shift in consumer preference to utilize BNPL arrangements to pay for health services. Approximately $230 million of health services were paid for using BNPL payment arrangements in 2021, up from $10 million in 2019, based on a Consumer Financial Protection Bureau report released in September 2022. This signals consumer purchasing habits are making their way into the health care ecosystem, which historically has been slow to adopt to new technologies.

As previously noted, BNPL is here to stay as Fortune 500 technology companies and card networks provide BNPL offerings. In the U.S., the use of BNPL is projected to increase to 8.5% in total e-commerce spend by 2025, from only 3.8% as of 2021, according to the 2022 FIS Global Payments report. Moreover, BNPL usage by generation shows it’s becoming mainstream. Users of BNPL range from baby boomers to Gen Z, although millennial and Gen Z customers are leading the adoption of BNPL, per Bloomberg.

Affordability issues in health care have also led to an increase in fintech companies focusing on the health care industry.

Since 2020, $53 billion of capital has been invested into the health care industry related to fintech solutions, which exceeds the total capital infused into the health care ecosystem from 2012 to 2019, according to Pitchbook. This may imply that consumer needs are changing, investors are noticing and health care organizations should likely consider super apps and alternative payment methods, such as BNPL.

The takeaway

Fintech can offer consumers a path to financially navigate their health care journey and allows organizations to find ways to enhance the consumer-centered experience. Most important, the health care and fintech alignment enables consumers to make more informed decisions to financially plan for their health.