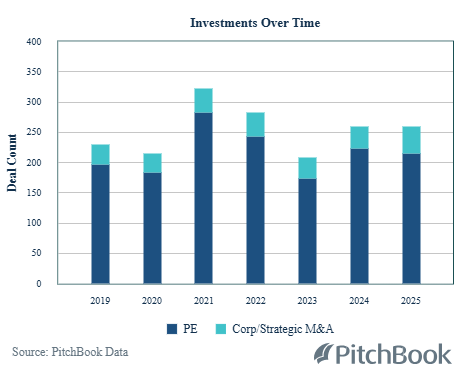

Health care consolidation and private equity deals have not returned to the levels seen in 2021 and 2022. Mergers and acquisitions and private equity transaction activity have gained some ground but continues to lag.

The continued lag is likely due to a confluence of events. Health care providers faced significant financial pressures in 2025 from forces such as inflation, high labor costs and reimbursement uncertainties. Throughout last year, inflation rose approximately 3%. Labor costs represented 56% of total hospital costs and total labor costs increased 3 to 4% in 2025. In addition, the health care industry continues to face challenges resulting from the impact of the One Big Beautiful Bill Act (OBBBA).

Key OBBBA-related concerns include cuts to Medicare and Medicaid as well as further anticipated increases in uninsured patient populations due to new Medicaid work requirements to confirm coverage. States are grappling with the administrative complexity of implementing new Medicaid eligibility and work requirements. In addition, many providers are bracing for an increase in uninsured patients in 2026 and beyond due to insurance premium increases which are expected to increase by 18% this year.

What’s on the horizon?

Operational pressures and rising costs continue to challenge health care providers, intensifying the need for greater efficiency and scale. At the same time, historical M&A and private equity activity signal a pent‑up demand for consolidation that is likely to accelerate in the year ahead.

Leadership turnover—including retirements and broader C‑suite transitions—is reshaping strategic direction across hospitals nationwide. New executives are reassessing market positions, exploring expansion strategies and evaluating potential merger partners to strengthen service offerings.

Regional health systems, in particular, are expected to pursue opportunities to grow their footprint and expand complementary services within their geographic markets, responding to competitive pressures and shifting patient needs.

Meanwhile, private equity firms will look beyond traditional physician practice management. In 2026, investors are expected to prioritize segments with lower regulatory and reimbursement barriers—especially technology‑enabled solutions and other operationally efficient areas of the health care ecosystem.

The takeaway for providers

In this environment of mounting cost pressures, uncertainty and more, health care providers should take steps now to position themselves strategically. Organizations that proactively assess their operational readiness, clarify growth priorities and strengthen their financial footing will be better prepared to engage potential partners—or evaluate investor interest—on their own terms.

Providers should also revisit their long-term strategy, ensuring they have a clear view of where partnerships, affiliations or technology investments could accelerate performance or expand services. By approaching 2026 with a grounded understanding of their competitive position and a readiness to adapt, providers can navigate the coming wave of consolidation from a place of strength.

Shelby Burghardt

Shelby Burghardt is a senior manager for audit services and a health care senior analyst for RSM US LLP. With over 17 years of experience, she provides financial statement audit, single audit and agreed-upon procedures services for clients in the health care and nonprofit industries. Shelby has served a variety of health care and nonprofit organizations, including academic medical centers, hospitals and health systems, behavioral health organizations, as well as private equity-backed health care companies. In addition, as a member of the firm’s Industry Eminence Program, Shelby works alongside the firm’s chief economist and her fellow senior analysts to understand, forecast and communicate economic, business and technology trends affecting middle market businesses.