By Louise Grubb, TriviumVet, CEO

The US Animal Health industry has long been the forerunner of the industry globally. Over the past few generations our pets have made the move from the back yard, to the couch, and into our beds. We have never been closer to our furry companions, and this has been fully reflected across the veterinary industry. COVID-19 has significantly punctuated any predictions that were made about industry trends and has caused for much recalculation. So how was the US veterinary industry performing? How has COVID-19 has impacted it? What are the predictions on how this impact will bare upon its future growth?

Growth Upon Growth

According to The American Pet Products Association, the overall spending in the U.S. pet industry increased to USD 95.7 billion in 2019 from USD 90.5 billion in 2018, and it is estimated it reached USD 99.0 billion in 2020. There have been a number of key drivers that have supported this growth such as owner demographics, the pet population, the introduction of corporate veterinary practices, and most importantly our relationship with our pets. Animlaytix, a key industry commentator reported that 2020 pharmaceutical product sales grew 7.6%; driven by strong companion animal (dogs/cats/horses) and vet practice supply category performance.

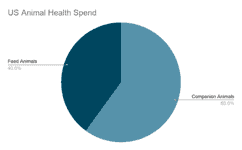

One of the most interesting dynamics of the US market versus the global animal health market is that globally the split between companion animal spend and feed animals is 40% to 60% while in the US it is the reverse with 60% of spend going towards companion animals. (Animlaytix Feb 2020 Spirit of Service presentation)

According to a report from the American Pet Products Association 67.0% of US households (84.9 million homes) own at least one pet. Advancements in technology that supports more insightful diagnostics and treatments have allowed our pets to live longer than ever before. This has resulted in an increase in age-related disease and obesity leading to further trips to the vet and medical bills.

Similar to human healthcare one of the key drivers of the US veterinary industry is insurance. Pet insurance costs are expected to rise on average by 8.4% year on year to 2024 where the industry will be valued at $1.93 billion.

Key Trends on the Rise

Dog and cat populations are two of the most central trends in the health of the veterinary industry. The dog population has risen from 71.0 million in 2005 to 88.7 million in 2020. While the cat population has risen from 81.0 million to 104.1 million across the same time. This is one statistic that COVID-19 has been unable to dampen as 2024 predictions expect to see populations of 93.2 million and 109.7 million respectively. In 2020 the American Veterinary Medicine Association reported that 80% of dogs and 55% of cats are annually brought to their veterinarian clinics. It is a cat’s instinctive nature to hide any illness or injury, as programmed into their DNA from the days when they were prey. While dogs at the top of the food chain have absolutely no problem in playing the victim. However, these figures also reveal that the market has plenty of scope to grow and is not mature.

This market growth is influenced by the increased life span of our pets. As our pets live longer, we grow even closer, and we want to treat their age-related diseases and are willing to pay to do so. The relationships between pets and the owners is clearly reflected in how much we are willing to spend on our pets. In 2014 the average price for a veterinarian visit was $145.2, which has shifted to $172.2 today, and is expected to continue to grow to $190.0 by 2024.

The Blip on the Map

2020 posed significant challenges to almost every business, with many industries disproportionately affected. Thankfully for the veterinarian industry, the love for our pets not only endured by thrived thanks to the sizeable shifts in how we live our lives.

Without a commute to occupy our lives, no extracurricular activities to entertain, and an endless supply of walks to fill up our days, many individuals and families decided to welcome companion animals into their homes. The increased amount of time that we shared with our pets also gave rise to how we felt about them. Encouraged to eat, drink, and socialize outdoors, we brought our pets with us, shared adventures with them, and grew even closer to them again.

ShelterWatch Covid-19 impact report illustrated that while total pet adoptions dropped by 24% or ~ 250,000 pets in 2020, shelter intakes declined by more than 550,000 animals in 2020, reducing the number of pets available for adoptions but increasing the number of animals in the market being looked after.

Post Covid-19

Even with the challenges of 2020 the US Veterinary Industry has shown considerable and quality growth since the 2010 recession. This growth is set to reset itself to its pre-COVID track and continue to extend to 2024 at the very least.

Who we are as a society will continue to shape our pets lives, as it always has. Empty Nesters (55-64) make up the second fastest growing age group in the United States and have previously been responsible for driving premium pet foods and services along with Baby Boomers. However, this group is quickly becoming surpassed by young professionals in terms of pet spend.

Millennials are bucking the historic work-life balance culture, prioritizing more time away from the desk through working less, or working flexibly. Demographic pyramids can show that the baby boom is long over, and this generation is keener to spend the money on themselves, rather than expanding their family unit. With the exception of course to their furry companions with which they are willing to spend more than any previous generation.

The most pivotal variable in the veterinary industry is how much the average pet owner is willing to spend on their companion animal. As advancements in animal health allow our cats, dogs, and horses to live longer and in greater comfort, it is clear there is significant potential for innovation in healthcare, improved pharmaceuticals, and diagnostic products.

Industry challenges

The most significant challenges facing the industry will be keeping pace with this strong demand. As most veterinary hospitals find themselves at capacity price increases are inevitable and Animalytix is projecting increases of between 7-9%, a continued shortage of registered veterinarians and qualified employees will push wages upwards putting pressure on practice margins and profitability. Another significant issue with the pressures of Covid-19 and spiralling demand is veterinarian burnout. Many studies have shown the burnout rate is increasing across the veterinary practice from the veterinarian to the vet technician. Research from Frontiers in Veterinary Science published in 2020 illustrated that over 50% of 1,642 practicing veterinary technicians were suffering from burnout.

The future

One thing is certain from the strong performance of the animal health industry over the past 10 years and its ability to rebound in a post pandemic era – pets are now part of the family and their healthcare has become a physical, emotional, and financial priority. We at TriviumVet predict an innovation surge in specialty drug and diagnostic products and a steady increase in the medicalization of pets.

About the Author:

Louise Grubb is the founder and Chief Executive Officer of TriviumVet, which was named one of the top 100 startups in Ireland in 2020 and 2019. She has more than 20 years of experience in the veterinary and pharmaceutical industries. Her previous roles include founder of NutriScience, a global developer and supplier of dietary and wellness supplements for animals, and founder of Q1 Scientific, a firm specializing in the stable storage of human and veterinary pharmaceutical products. In 2016, she was a finalist in the Ernst and Young Entrepreneur of The Year Awards while leading Q1 Scientific.

The Editorial Team at Healthcare Business Today is made up of skilled healthcare writers and experts, led by our managing editor, Daniel Casciato, who has over 25 years of experience in healthcare writing. Since 1998, we have produced compelling and informative content for numerous publications, establishing ourselves as a trusted resource for health and wellness information. We offer readers access to fresh health, medicine, science, and technology developments and the latest in patient news, emphasizing how these developments affect our lives.