By Kyle Winkfield

From recent graduates receiving initial loan statements to mid-career professionals still paying for degrees, the question of paying student loans or saving for retirement affects many.

Without a doubt, student debt hits medical graduates hard – to the tune of $166,750, on average.

Before long, the shock of decades-long loan payments sets in, and suddenly, saving for retirement seems more fantasy than reality.

You want to pay the loans and prepare for the future. But we all have limited wealth.

Should yours go towards debt obligations or the future you?

Financial Masters

Debt can overwhelm your cash flow and hold you back economically. This master takes.

Conversely, saving for retirement can offer years of growth through compound interest. This master gives.

As the adage goes, you can’t serve two masters. You could try to pay loans and save for retirement, but that’s inefficient.

Given our limited means, laser focus is required to climb the wealth ladder. And the way up is one rung at a time.

The first step is a reserve fund of one- to six-months of expenses. Build that first.

Next? Deal with the debt, especially if you’re saving for retirement in any capacity (i.e., employer plan).

Snowballing Debt

The Debt Snowball technique harnesses your cash flow to quickly and efficiently eliminate debt. It’s a “snowball” because your debt-crushing power increases with time, like a snowball rolling downhill.

It requires discretionary income – the beginning snow. And honestly, most of us have discretionary income, or can have it by making different choices.

Effectively managing discretionary income is the key to quickening the repayment timetable without extra spending – it’s one of the best ways to ditch debt.

Know Thyself

Understand your cost of living, including minimum debt payments. Track spending for a month or two, which provides a baseline and illustrates the impact of different choices.

You’ll probably discover the daily coffee and dinners out add up. This is your discretionary income at work. You can’t control its flow if you don’t know where it goes.

Erasing debt is easier with more income, and you can probably “find” more of it by making different choices. But you have to balance that with your lifestyle.

Usually tracking spending reveals expenses we can live without. I call this “found wealth.” For the following example, let’s say we “found” $500.

Know Thy Debt

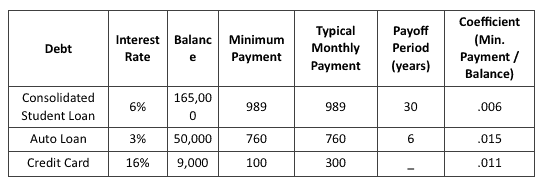

List your debts like the table below.

Include student loans, credit cards, auto loans and other consumer debts.

Target Thy Debt

People usually pay the minimum or slightly more. Why not focus those extras and the “found wealth” on one debt until it’s gone?

To do that, identify your “deadliest” debt. You can attack the highest interest rate, the largest balance or the highest minimum payment. Your personal situation, goals and motivation drive the decision.

I calculate a coefficient to make it easy (last column above). Divide each debt’s minimum payment by its balance, then attack the one with the lowest coefficient first. Here it’s the student loan.

Erase Thy Debt

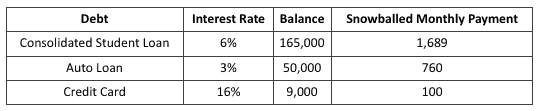

Allocate minimum payments for the auto loan and credit card. Then aim your discretionary income ($500) and the “extras” ($200) at the student loan. Here’s the “snowballed payment” table.

The student loan payment is now $1,689, and will jump to about $2,500 once the auto loan is gone. In total, this plan decreases the student loan repayment amount by nearly $137,000 and eliminates it altogether in just over nine years!

Keep snowballing until all the debt is gone!

After the student loan, take all $2,500 and pay the credit card – you won’t miss the money because you’ve already been living without it. The new payment ($2,550) will eliminate the credit card debt in a matter of months after the student loans. Here are some of the best credit cards for students.

Congratulations, we just wiped out $224,000 of debt in less than 10 years! With discipline and financial efficiency, the debt snowball leads you to freedom.

Building Wealth

The real cost of debt is that it delays accumulation. With debt gone, you can truly build wealth!

In our example, we now have $2,550 available monthly to invest. In truth, it’ll probably be more because income often increases over time with raises, bonuses and the like.

Ultimately, it’s not what you make, but what you keep. Set the foundation for successful retirement savings by first snowballing student debt. You’ll keep more of your money and pave the way for a prosperous financial future.

The Editorial Team at Healthcare Business Today is made up of skilled healthcare writers and experts, led by our managing editor, Daniel Casciato, who has over 25 years of experience in healthcare writing. Since 1998, we have produced compelling and informative content for numerous publications, establishing ourselves as a trusted resource for health and wellness information. We offer readers access to fresh health, medicine, science, and technology developments and the latest in patient news, emphasizing how these developments affect our lives.